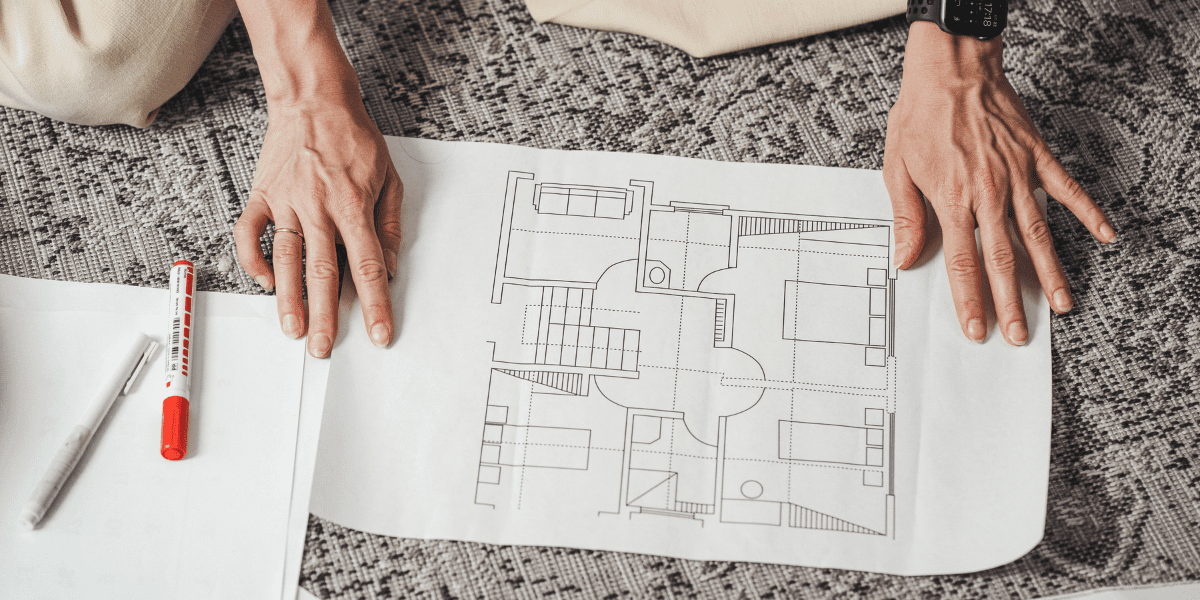

Buying a new home is big decision that requires research, list-making, and potentially long discussions with your home builder to ensure you’re on the same page. When you add a few family members, a significant other or spouse, things might become even more complicated. Before you can jump on the home-hunting and eventual home-buying bandwagon, there are a few ways to tell if you’re really ready to buy a new home.

Are You Ready to Jump on the Home-Buying Bandwagon?

The first thing you need to ask yourself is what you want in a home and why you’re turning to home buying. Perhaps you’re looking for a great investment, or maybe you’ve outgrown your current place and want to find something more suitable for yourself and your family. Those are all good reasons to buy a new home...but are you ready? Here are some things to consider before you contact your realtor.

Are You Committed?

Home ownership is not at all like renting. So if this will be your first home purchase, ask yourself if you’re ready for a long-term commitment. According to Jim Walton, vice president of consumer credit with MetLife Bank in Irving, Texas. "Homeownership requires a commitment to a property and to a community." It’s more than just a house payments and upkeep. There is maintenance involved both inside and out, and you want to be sure you can afford any upgrades or potential problems that might occur, such as plumbing issues or electrical problems. Those kinds of things can be costly, and can add up quickly. When you’re the homeowner, there’s no landlord to call when there’s trouble. Are you committed to being your very own landlord?

Do You Know the Cost?

Sure, you probably know that you’ll have to pay your mortgage, and property taxes, even insurance on your home. But are you prepared for potential increases in property taxes, and do you know what the estimated utility bills might be in your new home? If you’re looking to upgrade, there’ll be more heating and cooling, and costs to keep the lights on, too. Also, you’ll have to factor in expenses for yard care, pool maintenance (if that’s applicable), and anything else that may come with your new home. So you know the price tag, but have you calculated all the costs of living in your new home?

With those details in mind, consider whether it’s time to house hunt or extend your lease and remain a renter. If you’ve decided that home ownership is your next best step, contact Country Classics today for helpful tips, tools and guidance on your home-buying journey.

Leave a Comment